# Simulate data

n <- 20

k <- 3

nationality <- round(runif(n,1,k),0)

nationality <- factor(nationality)

levels(nationality) <- c("Dutch", "German", "Belgian")

mu.covar <- 8

sigma.covar <- 1

openness <- round(rnorm(n,mu.covar,sigma.covar),2)

# Create dummy variables

dummy.1 <- ifelse(nationality == "German", 1, 0)

dummy.2 <- ifelse(nationality == "Belgian", 1, 0)

# Set parameters

b.0 <- 15 # initial value for group 1

b.1 <- 3 # difference between group 1 and 2

b.2 <- 4 # difference between group 1 and 3

b.3 <- 3 # Weight for covariate

# Create error

error <- rnorm(n,0,1)12. ANCOVA

ANCOVA

ANCOVA

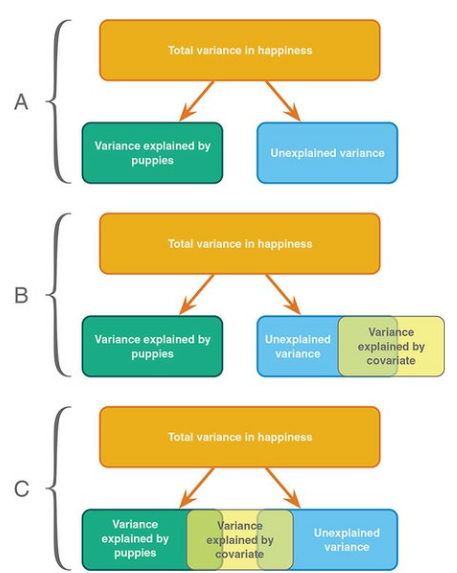

Analysis of covariance (ANCOVA) is a general linear model which blends ANOVA and regression. ANCOVA evaluates whether population means of a dependent variable (DV) are equal across levels of a categorical independent variable (IV) often called a treatment, while statistically controlling for the effects of other continuous variables that are not of primary interest, known as covariates (CV).

ANCOVA

Determine main effect while correcting for covariate

- 1 dependent variable

- 1 or more independent variables

- 1 or more covariates

A covariate is a variable that can be a confounding variable biasing your results. By adding a covariate, we reduce error/residual in the model.

Assumptions

- Same as ANOVA

- Independence of the covariate and treatment effect §13.4.1.

- No difference on ANOVA with covar and independent variable

- Matching experimental groups on the covariate

- Homogeneity of regression slopes §13.4.2.

- Visual: scatterplot dep var * covar per condition

- Testing: interaction indep. var * covar

Independence of the covariate and treatment effect

Data example

We want to test the difference in national extraversion but want to also account for openness to experience.

- Dependent variable: Extraversion

- Independent variabele: Nationality

- Dutch

- German

- Belgian

- Covariate: Openness to experience

Simulate data

Define the model

\({outcome} = {model} + {error}\)

\({model} = {independent} + {covariate} = {nationality} + {openness}\)

Formal model

\(y = b_0 + b_1 {dummy}_1 + b_2 {dummy}_2 + b_3 covar\)

# Define model

outcome <- b.0 + b.1 * dummy.1 + b.2 * dummy.2 + b.3 * openness + errorDummies

The data

Observed group means

aggregate(outcome ~ nationality, data, mean) nationality outcome

1 Dutch 38.67000

2 German 42.16625

3 Belgian 43.79800Model fit without covariate

What are the beta coefficients when we fit a model that only has “nationality” as a predictor variable?

fit.group <- lm(outcome ~ nationality, data); fit.group

Call:

lm(formula = outcome ~ nationality, data = data)

Coefficients:

(Intercept) nationalityGerman nationalityBelgian

38.670 3.496 5.128 fit.group$coefficients[2:3] + fit.group$coefficients[1] nationalityGerman nationalityBelgian

42.16625 43.79800 \({Dutch} = 38.67 \> {German} = 42.16625 \> {Belgian} = 43.798\)

Model fit with only covar

What are the beta coefficients when we fit a model that only has the covariate as predictor variable?

fit.covar <- lm(outcome ~ openness, data)

fit.covar

Call:

lm(formula = outcome ~ openness, data = data)

Coefficients:

(Intercept) openness

15.667 3.185 Model fit with all predictor variables (factor + covariate)

fit <- lm(outcome ~ nationality + openness, data); fit

Call:

lm(formula = outcome ~ nationality + openness, data = data)

Coefficients:

(Intercept) nationalityGerman nationalityBelgian openness

15.965 2.769 4.181 2.881 fit$coefficients[2:3] + fit$coefficients[1] nationalityGerman nationalityBelgian

18.73401 20.14609 \({Dutch} = 15.96 \> {German} = 18.73 \> {Belgian} = 20.14\)

So what do we predict for each participant??

For a German with a score of 8 on Openness:

fit <- lm(outcome ~ nationality + openness, data); fit$coefficients (Intercept) nationalityGerman nationalityBelgian openness

15.964661 2.769346 4.181430 2.880866 unname(fit$coefficients[1] + 1 * fit$coefficients[2] + 0 * fit$coefficients[3] +

8 * fit$coefficients[4])[1] 41.78093How about a Belgian with 6 Openness?

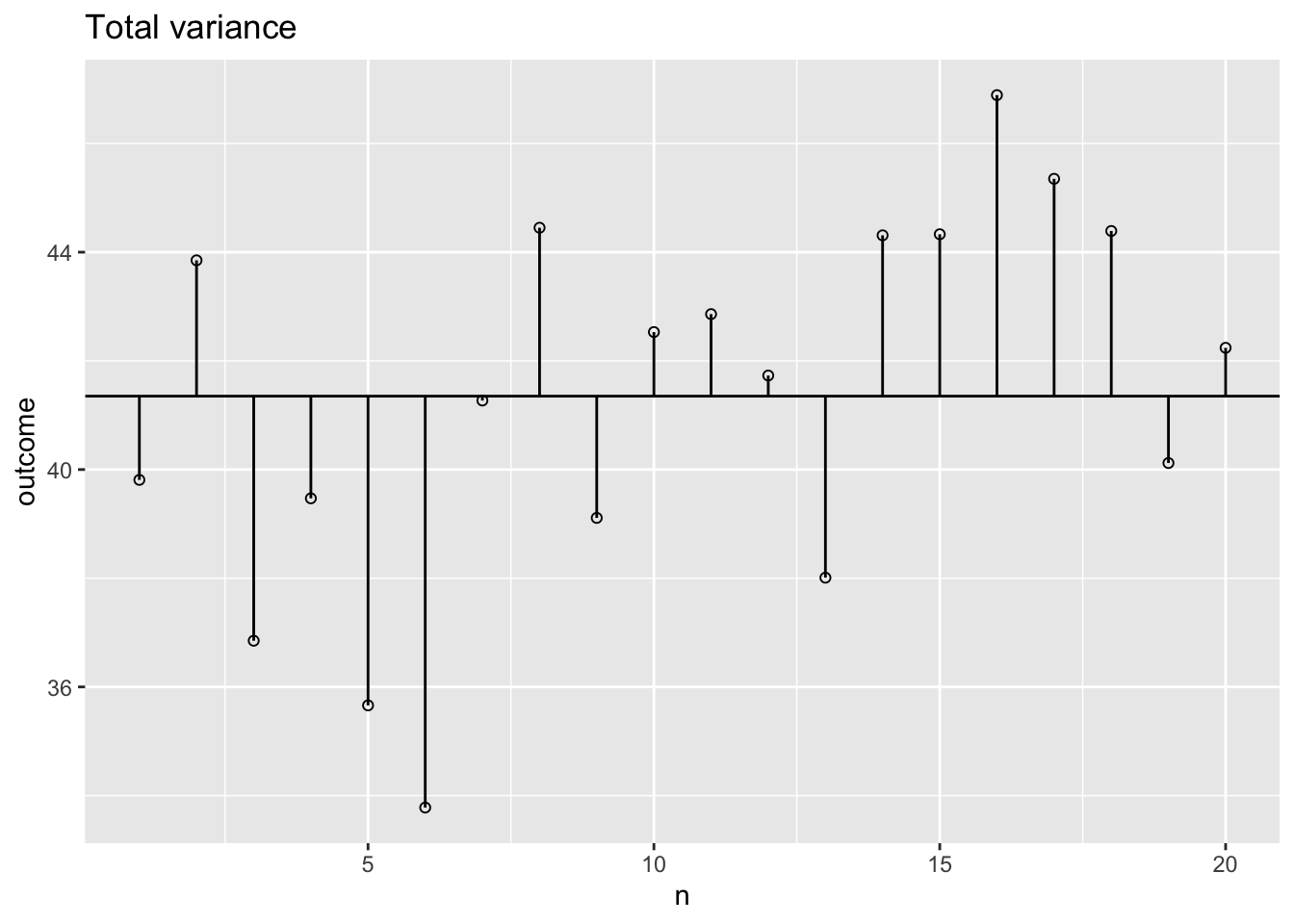

Total variance

What is the total variance?

\({MS}_{total} = s^2_{outcome} = \frac{{SS}_{outcome}}{{df}_{outcome}}\)

ms.t <- var(data$outcome); ms.t[1] 11.97756ss.t <- var(data$outcome) * (length(data$outcome) - 1); ss.t[1] 227.5737The data

Total variance visual

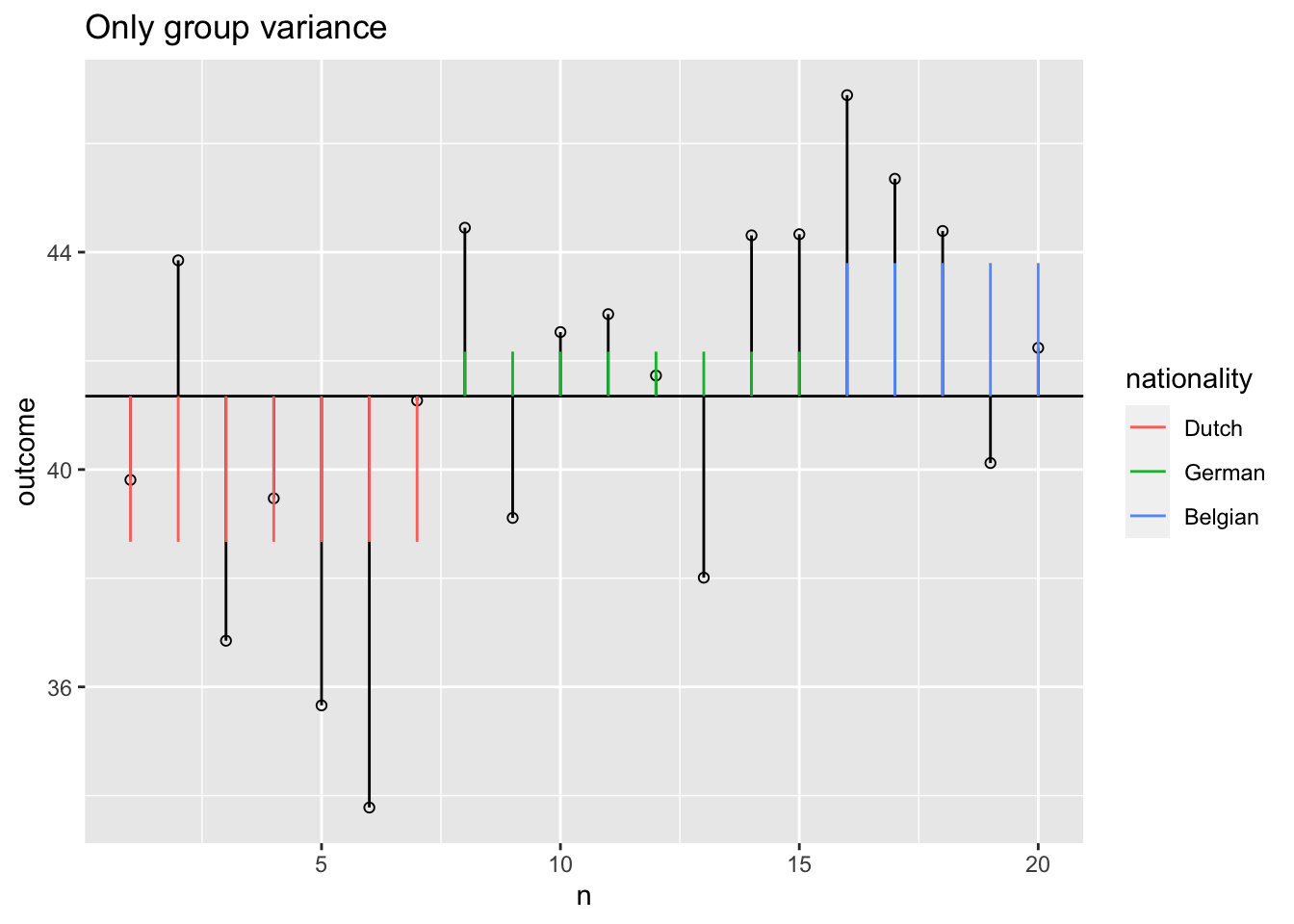

Model variance group

The model variance consists of two parts. One for the independent variable and one for the covariate. Lets first look at the independent variable.

Model variance group visual

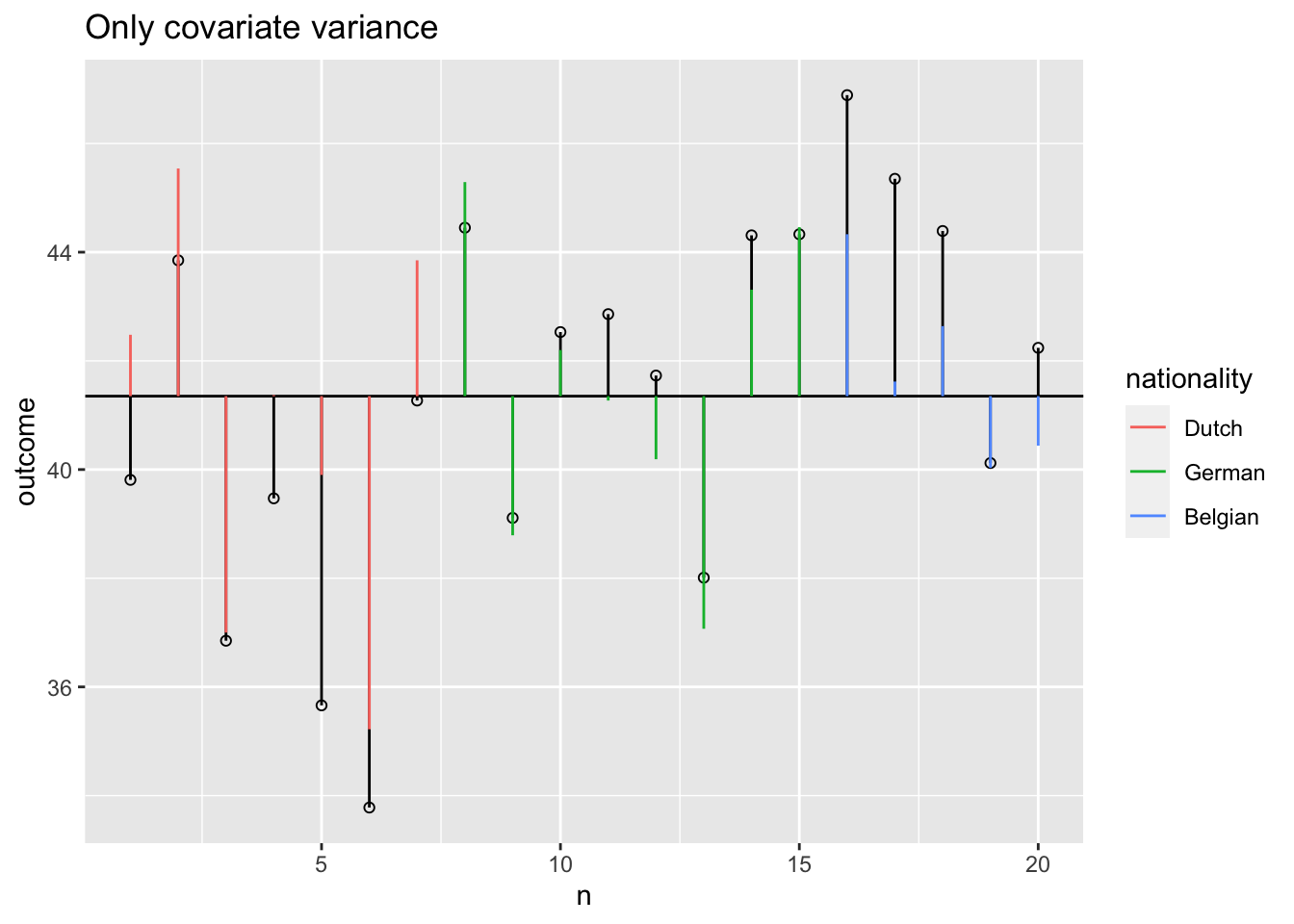

Model variance covariate visual

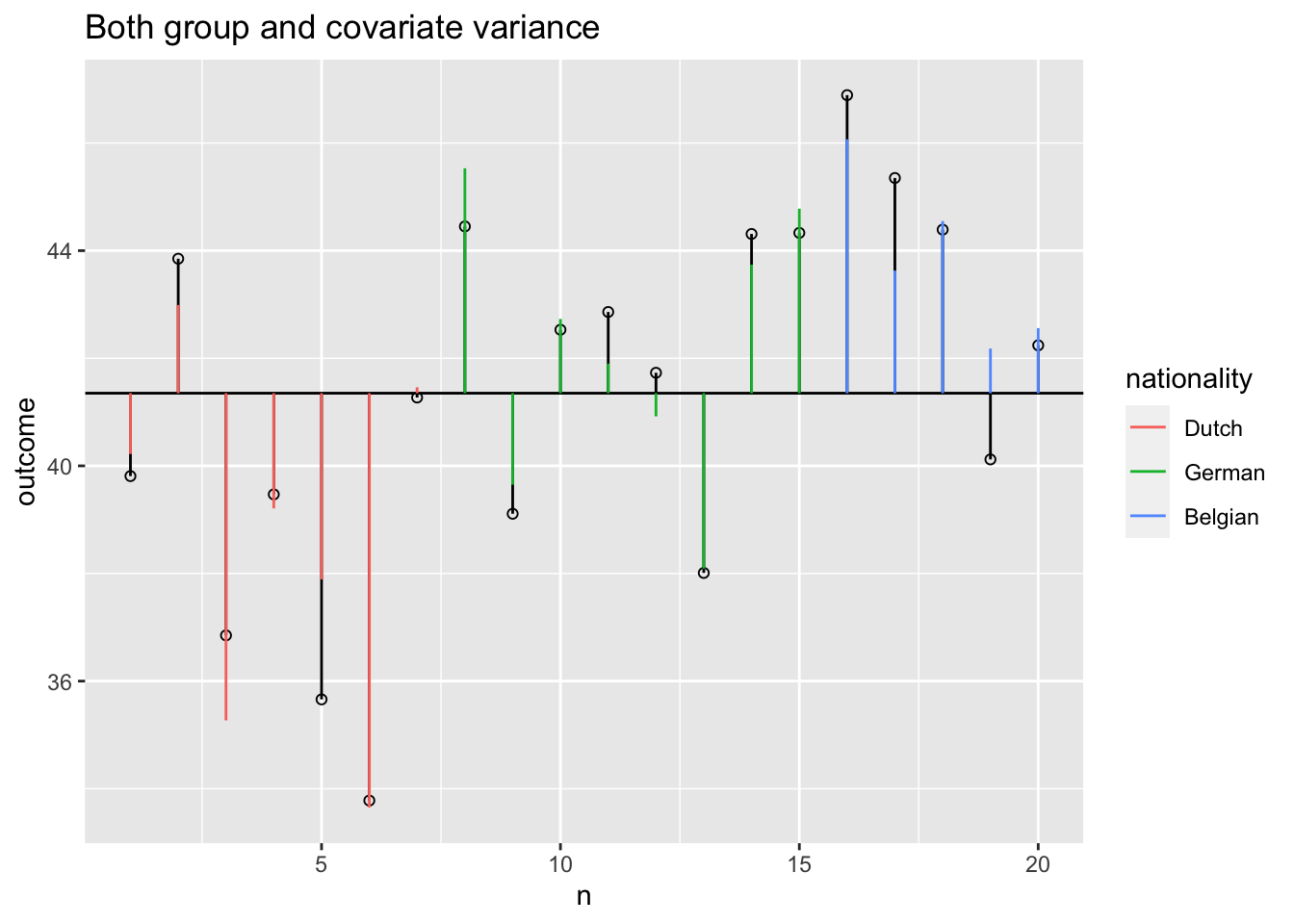

Model variance group and covariate

Model variance group and covariate visual

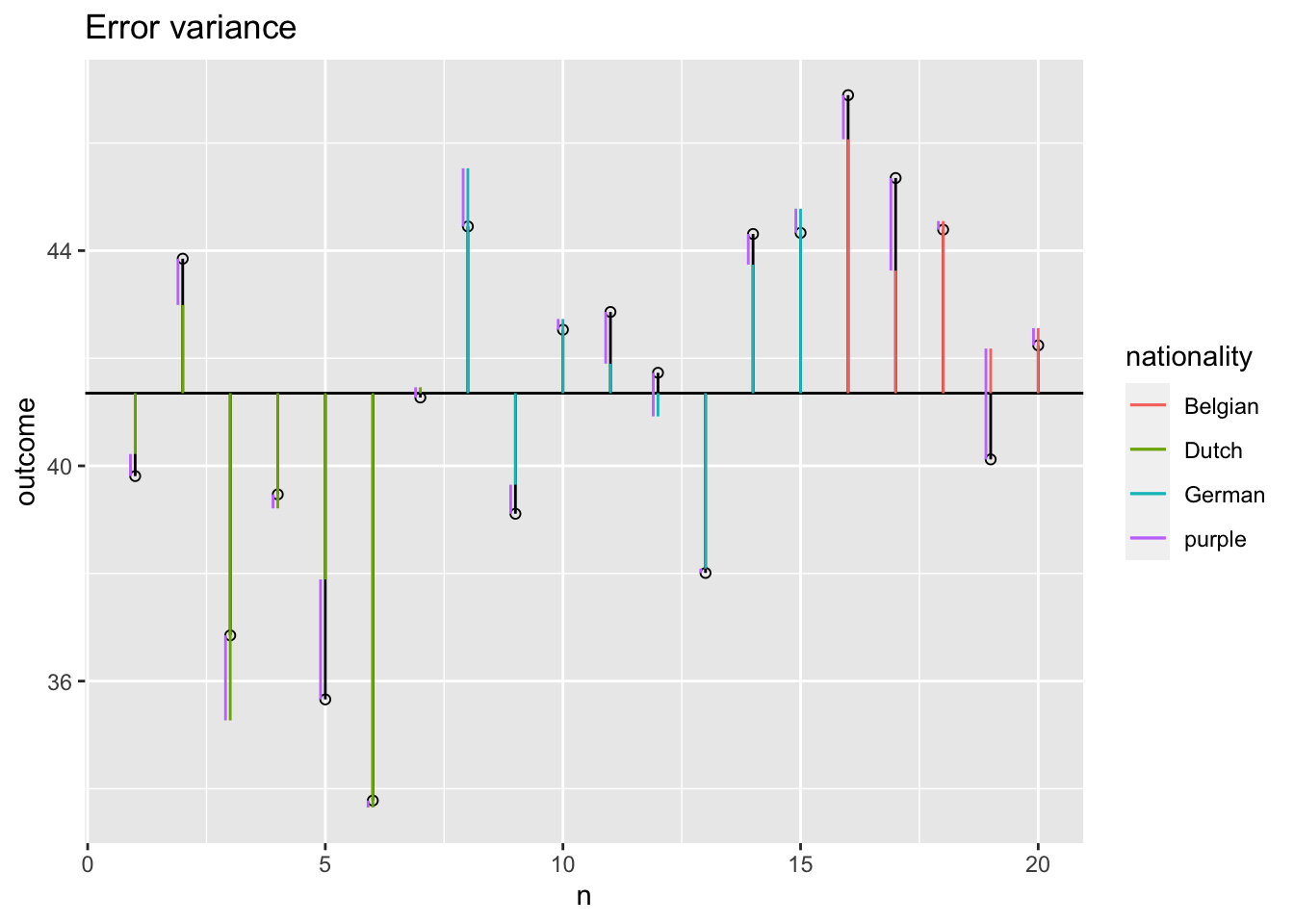

Error variance with covariate

Sums of squares

SS.model <- with(data, sum((model - grand.mean)^2))

SS.error <- with(data, sum((outcome - model)^2))

# Sums of squares for individual effects

SS.model.group <- with(data, sum((model.group - grand.mean)^2))

SS.model.covar <- with(data, sum((model.covar - grand.mean)^2))

SS.covar <- SS.model - SS.model.group; SS.covar ## SS.covar corrected for group[1] 121.8463SS.group <- SS.model - SS.model.covar; SS.group ## SS.group corrected for covar[1] 54.65778F-ratio

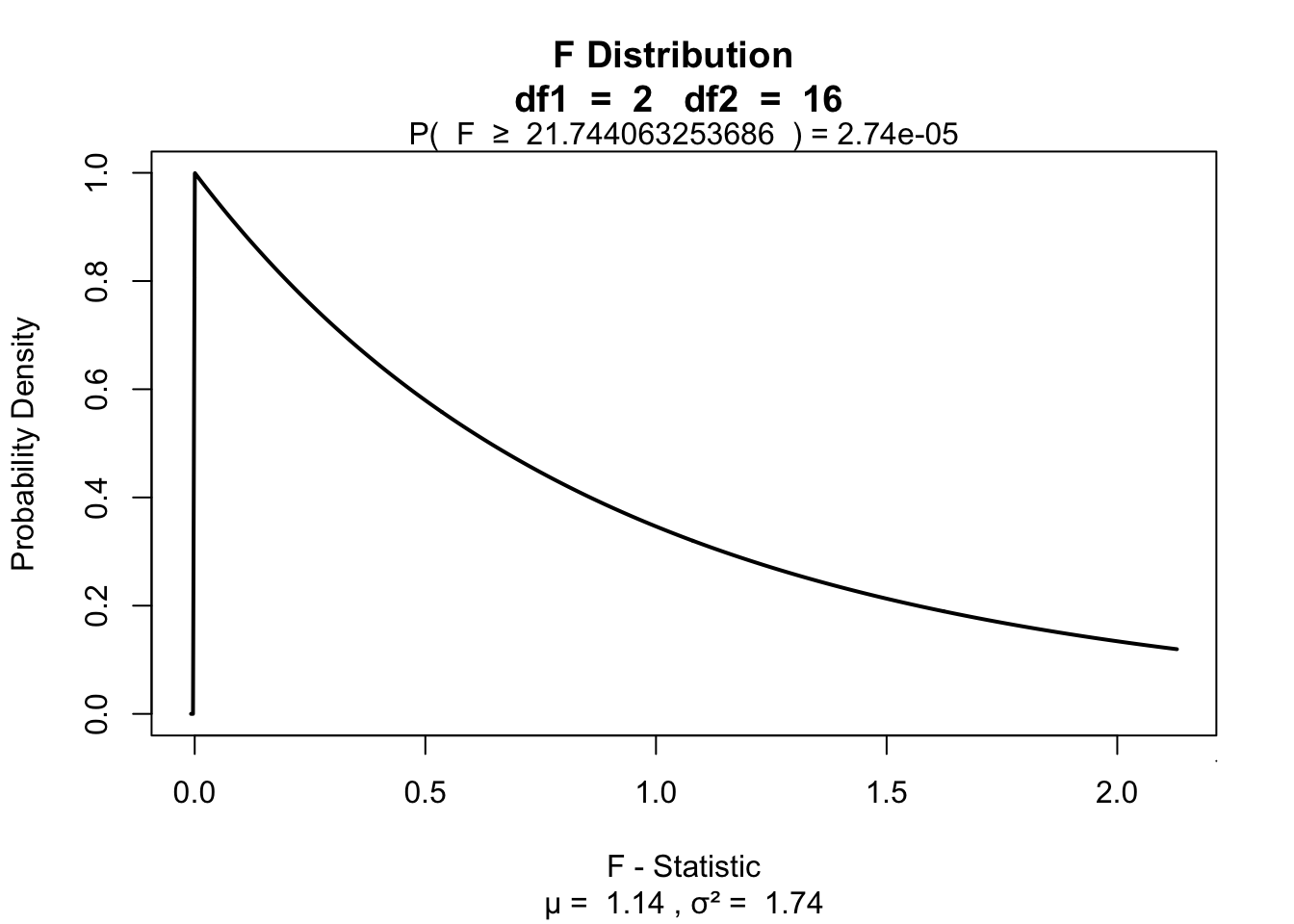

\(F = \frac{{MS}_{model}}{{MS}_{error}} = \frac{{SIGNAL}}{{NOISE}}\)

n <- 20

k <- 3

df.model <- k - 1

df.error <- n - k - 1

MS.model <- SS.group / df.model

MS.error <- SS.error / df.error

fStat <- MS.model / MS.error

fStat[1] 21.74406\(P\)-value

library("visualize")

visualize.f(fStat, df.model, df.error, section = "upper")

Alpha & Power

Power becomes quite abstract when we increase the complexity (i.e., number of predictors) of our models. We can make an F-distribution that symbolizes the alternative distribution by shifting the distribution more to the right (although the interpretability becomes pretty murky..) ::: {.cell} ::: {.cell-output-display}  ::: :::

::: :::

Adjusted/marginal means

Marginal means are estimated group means, while keeping the covariate equal across the groups

These are then the means that are used for follow-up tests, such as contrasts and post hoc tests

See also this blogpost I wrote a while ago

Adjusted/marginal means

# Add dummy variables

data$dummy.1 <- ifelse(data$nationality == "German", 1, 0)

data$dummy.2 <- ifelse(data$nationality == "Belgian", 1, 0)

# b coefficients

b.cov <- fit$coefficients["openness"]; b.int = fit$coefficients["(Intercept)"]

b.2 <- fit$coefficients["nationalityGerman"]; b.3 = fit$coefficients["nationalityBelgian"]

# Adjustment factor for the means of the independent variable

data$mean.adj <- with(data, b.int + b.cov * mean(openness) + b.2 * dummy.1 + b.3 * dummy.2)

aggregate(mean.adj ~ nationality, data, mean) nationality mean.adj

1 Dutch 39.19740

2 German 41.96675

3 Belgian 43.37883aggregate(outcome ~ nationality, data, mean) nationality outcome

1 Dutch 38.67000

2 German 42.16625

3 Belgian 43.79800